Unggulan

- Dapatkan link

- Aplikasi Lainnya

Country Money Laundering Risk Ratings

The concept of cash laundering is very important to be understood for those working within the financial sector. It's a process by which dirty money is transformed into clean money. The sources of the money in actual are criminal and the cash is invested in a manner that makes it appear like clear money and hide the identity of the felony part of the money earned.

While executing the monetary transactions and establishing relationship with the new clients or sustaining current prospects the duty of adopting sufficient measures lie on each one who is a part of the organization. The identification of such factor to start with is easy to cope with as an alternative realizing and encountering such situations afterward within the transaction stage. The central financial institution in any country offers full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such situations.

This approach the risk-based approach is central to the effective implementation of the FATF Standards and also applies to financial institutions and designated non-financial. The Basel AML Index is an independent annual ranking that assesses the risk of money laundering and terrorist financing MLTF around the world.

Eu List Of Third Parties Deep Dive Comparison Raises More Questions Ethiopia Mauritius Financial Crime News

Over 200 jurisdictions around the world have commited to the FATF Recommendations through the global network of FSRBs and FATF memberships.

Country money laundering risk ratings. As of October 2018 the FATF has reviewed over 80 countries and. The FATF identifies jurisdictions with weak measures to combat money laundering and terrorist financing AMLCFT in two FATF public documents that are issued three times a year. B Third countries with effective mechanisms to combat money laundering and financing of terrorism.

The domicile has some weaknesses in its anti-money laundering laws. Geographical risk factors characterise situations which potentially involve an increased risk Appendix 3. KnowYourCountry Limited has achieved ISO 90012015 Certification for the provision of on-line information of money laundering and sanction information on a country by country basis.

35 countries went backwards. Every year US. In fact only six countries improved their scores by more than one point.

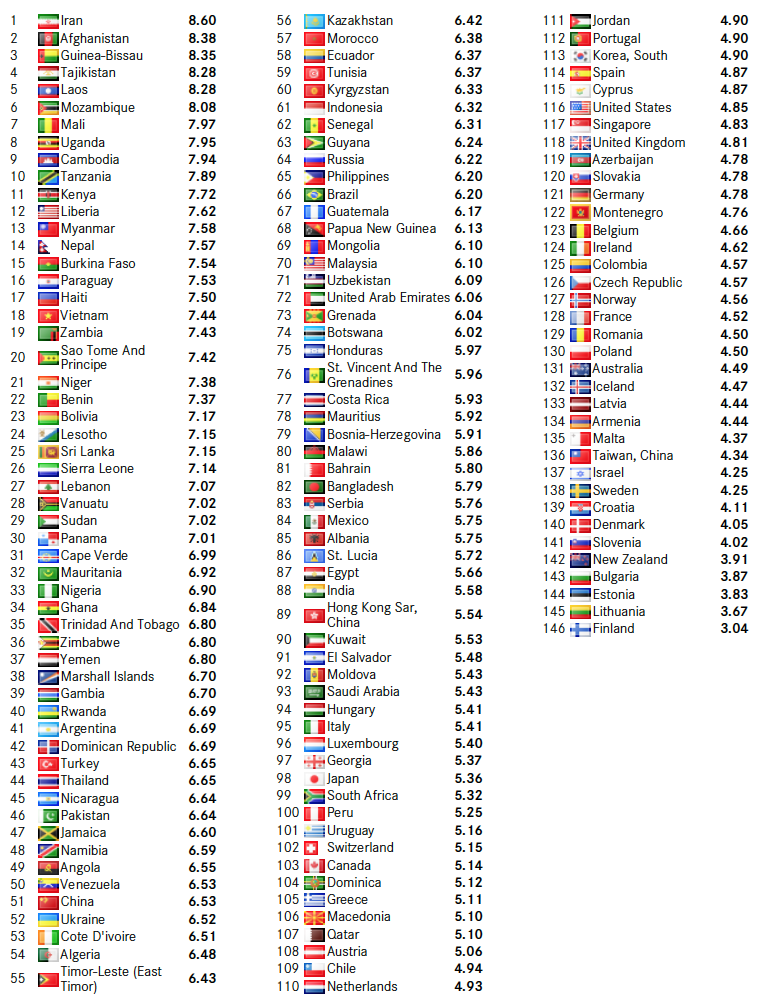

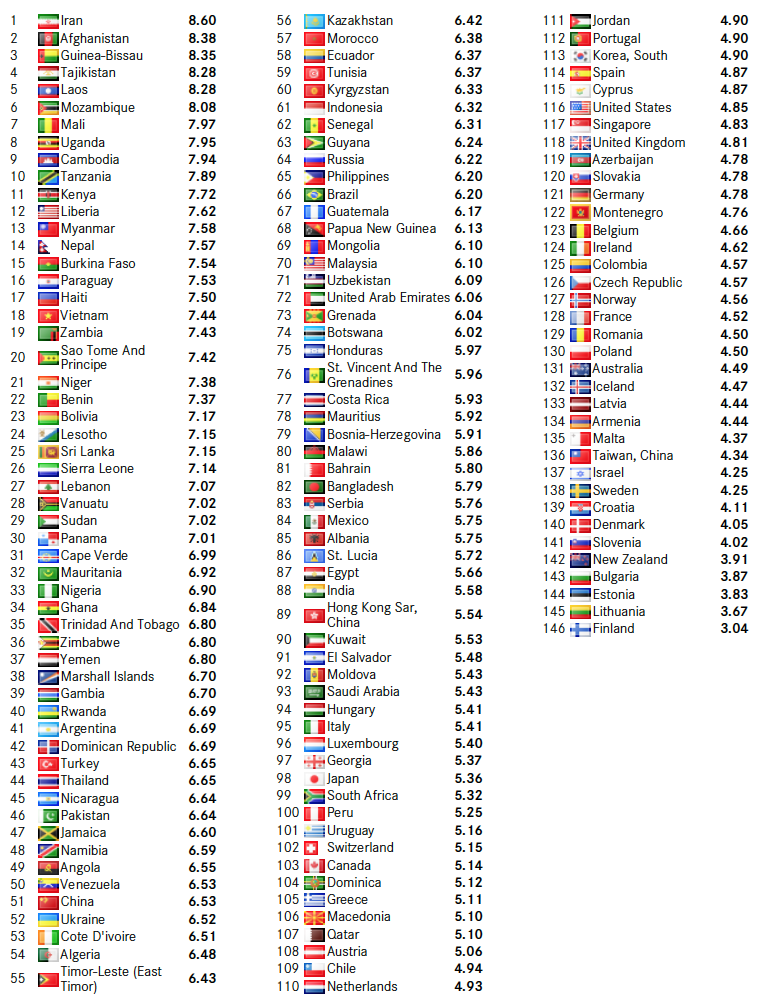

All listed countries below are defined as such. The domicile has low or non-existent anti-money laundering. The average MLTF risk score across all 141 countries in the 2020 Public Edition of the Basel AML Index remains unacceptably high at 522 out of 10 where 10 equals maximum risk.

This module aims to assist authorities in evaluating money laundering and terrorist financing risks arising from both existing and emergingnew financial inclusion products and can be used as a basis for designing a risk-based approach in the preventive measures. A EU or EEA countries. Officials from agencies with AML responsibilities assess the money laundering situations in approximately 200 jurisdictions.

It can also be used by regulators to design low or lower MLTF risk financial products. The FATFs process to publicly list countries with weak AMLCFT regimes has proved effective click here for more information about this process. Medium country money laundering risk rating.

A domicile may have one of three country money laundering risks. A total of 17 countries were labeled as high-risk and non-cooperative jurisdictions by FATF. The assessment process starts during the workshop and usually continues for 5.

Normal country money laundering risk rating. Once these risks are properly understood countries will be able to implement anti-money laundering and counter terrorist financing measures that mitigate these risks. These requirements have been strengthened by the Fifth Anti-Money Laundering Directive.

Geographical risk factors characterise situations which potentially pose a limited risk Appendix 2. Working Group members also get hands-on training on the Risk Assessment Tool. The country has high risks relating to the poor quality of its AMLCFT framework Domain 1 scoring 912 out of 10.

US Department of State Money Laundering assessment INCSR Cayman Islands is categorised by the US State Department as a CountryJurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. Counter-measures were in force only for Iran and the Democratic Peoples Republic of Korea DPRK North Korea. Our risk ranking tool has been designed to provide a measure of the money laundering risk of countries that your organisation might have client relationships with or doing business with.

The domicile has strong anti-money laundering regulations. High country money laundering risk rating. Russias risk level in the Basel AML Index has hit a record low following a December 2019 Financial Action Task Force FATF assessment that rated the countrys anti-money laundering and counter terrorist financing AMLCFT systems as reasonably effective.

Once these risks are properly understood countries can apply AMLCFT measures that correspond to the level of risk in other words. Laos has an overall score of 821 and continues to face a high risk of money laundering despite leaving the FATFs list of jurisdictions with strategic deficiencies in 2017. Based upon data collected from many international and government agencies we have subjectively weighted the findings to provide a free rating tool that is predominantly focused on money laundering.

This list shows the status of countries in the FATFs global network as well as jurisdictions monitored by the FATFs International Co-operation Review Group. It was deemed Highly effective for 0 and Substantially Effective for 0 of the Effectiveness Technical Compliance ratings. The review includes an assessment of the significance of financial transactions in the countrys financial institutions involving proceeds of serious crime steps taken or not taken to address financial crime and money laundering each jurisdictions.

A risk assessment allows countries to identify assess and understand its money laundering and terrorist financing risks. Published by the Basel Institute on Governance since 2012 it provides risk scores based on data from 16 publicly available sources such as the Financial Action Task Force FATF Transparency International the World Bank and the World Economic Forum. The criteria included the availability and access to beneficial ownership information existence of effective proportionate and dissuasive sanctions in case of breaches of anti-money laundering and counter terrorist financing obligations as well as third countries practice in cooperation and exchange of.

The risk-based approach RBA. The workshop includes a brainstorming session on the money laundering and terrorist financing risks in the country.

Money Laundering Terrorist Financing Risk Assessment

Country Risk Methodology And Ratings Update Effective 26 Feb 2020 Arctic Intelligence

Report Ranks Estonia 2nd On List Of Low Risk Countries For Money Laundering The Baltic Course Baltic States News Analytics

Keeping Up With Money Laundering Risks Updates To This Year S Basel Aml Index Methodology Basel Institute On Governance

Global Money Laundering Risk Index Rises With Iran Rated Worst And Finland Least Risky Ctmfile

Money Laundering Risk Increases In Bangladesh

Basel Aml Index 2019 Basel Institute On Governance

Anti Money Laundering Policy With International Standards Must Be Adopted Immediately Transparency International Korea

Most Of See Countries Are Not In Risk Of Money Laundering And Terrorist Financing Drug Policy Network See

Money Laundering Risk Increases In Bangladesh

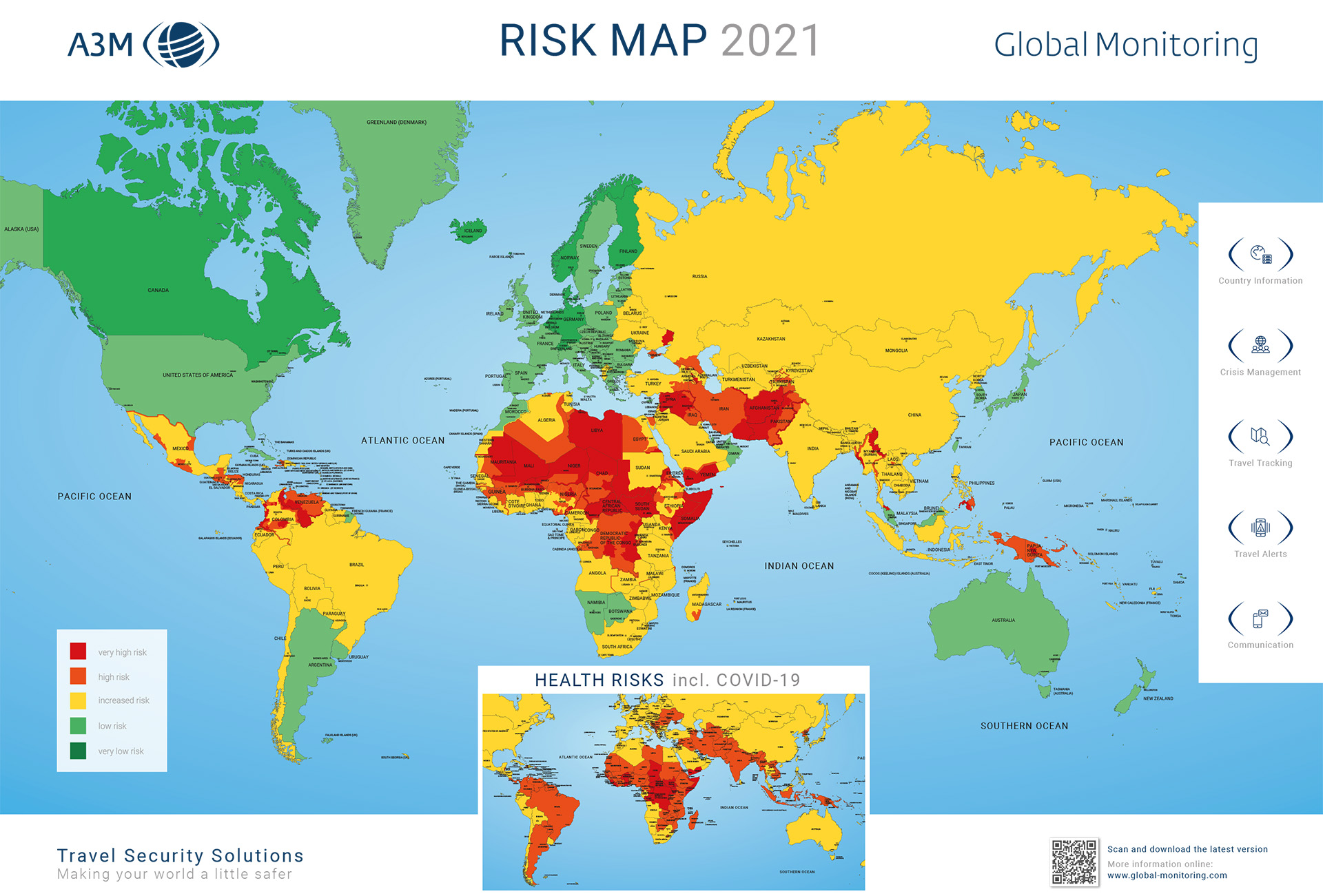

Risk Map A3m Global Monitoring

Eu Policy On High Risk Third Countries European Commission

Basel Anti Money Laundering Index

Anti Money Laundering Risk Assessment Identify The Risks And Vulnerabilities Web Nuk

The world of rules can look like a bowl of alphabet soup at occasions. US money laundering laws are no exception. We have now compiled a list of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting agency centered on protecting financial companies by decreasing threat, fraud and losses. Now we have massive bank expertise in operational and regulatory threat. We've a powerful background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus cash laundering brings many antagonistic consequences to the group because of the risks it presents. It increases the likelihood of main risks and the chance price of the financial institution and finally causes the financial institution to face losses.

- Dapatkan link

- Aplikasi Lainnya

Postingan Populer

Podcast Of The Bible

- Dapatkan link

- Aplikasi Lainnya

Aml 5 Directive Text

- Dapatkan link

- Aplikasi Lainnya

Komentar

Posting Komentar